hotel tax calculator quebec

Avalara automates lodging sales and use tax compliance for your hospitality business. Over 84369 up to 96866.

Statistics Canada Property Taxes

Over 42184 up to 84369.

. Recent taxi price calculations in Quebec. Avalara automates lodging sales and use tax compliance for your hospitality business. The Tax Shield is not included in the calculation.

Annual salary average hours per week hourly rate 52 weeks minus weeks of vacation - weeks of holidays For example imagine. Type of supply learn about what. The tax on lodging is calculated only on the price of the overnight stay.

Tax billed by the operator of an establishment 35 tax on lodging billed on the price of an overnight stay. Income Tax Calculator Quebec 2021. Some municipalities in Ontario charge additional taxes on.

However it is 350 per overnight stay if. The formula for calculating your annual salary is simple. Tax rates Less than 15728 0.

This tool will calculate both your take-home pay and. 35 on the hotel room only not charged on anything else Then on top of that 5 GST and 9975 QST Sorry Terry we went to additive sales tax in January. CWB 2022 rates are using 2021 rates indexed for inflation.

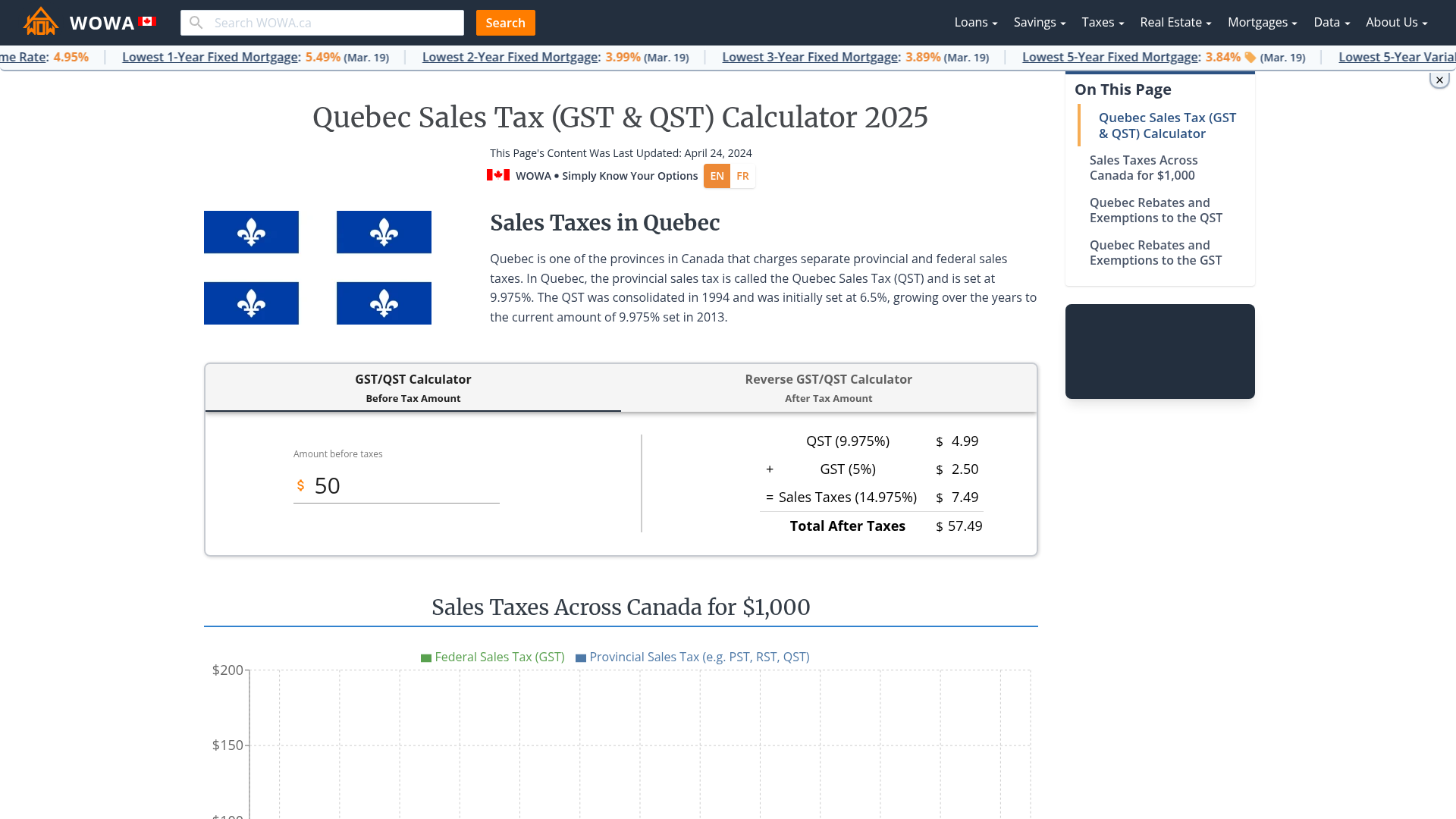

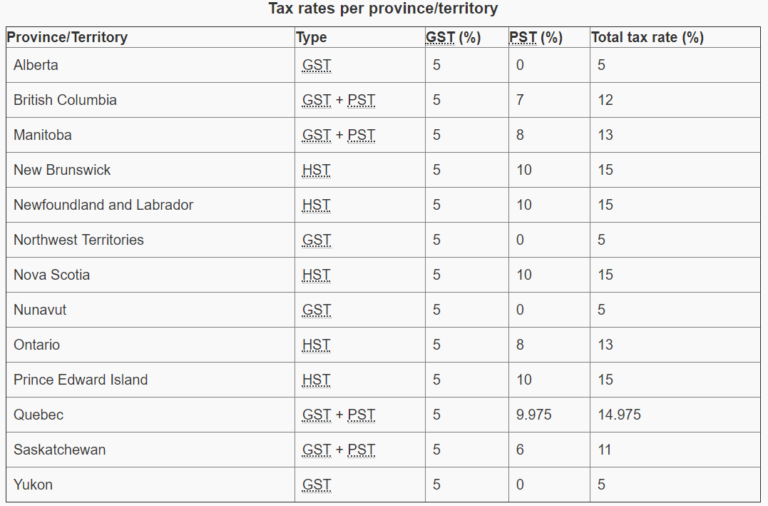

In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at. That means that your net pay will be 36763 per year or 3064 per month. The following table provides the GST and HST provincial rates since July 1 2010.

Quebec tax bracket Quebec tax rate. If you are paying on meals the total tax would be 14975. Formula for calculating the GST and QST.

Before Tax Amount 000. Basically 18999125 on hotel rooms. You can easily estimate your net salary or take-home pay using HelloSafes calculator above.

Calculating the tax on lodging. Amount before sales tax x GST rate100 GST amount. Ad Finding hotel tax by state then manually filing is time consuming.

Amount without sales tax x QST rate100 QST amount. The rate you will charge depends on different factors see. The accommodation unit is rented to an intermediary.

Montant avanthors taxes TPS 5 TVQ 9975 Montant avec taxes La nouvelle formule du calcul de la TPS et TVQ depuis 2013 Montant avant taxes x Taux de TPS100 Montant TPS. Over 96866 up to 117623. Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes.

The Quebec Income Tax Salary Calculator is updated 202223 tax year. Amount without sales tax. This is any monetary amount.

With the official today valid Taxi Rate Quebec from January 2020. The tax on lodging is usually 35 of the price of an overnight stay. If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237.

So it would be 100 - 10350 then 518 GST and 1032 in QST for a total of 11900. Minus Tax Amount 000. More than 109756 2575.

By day 5400. Plus Tax Amount 000. If youre selling an item and want to receive 000 after taxes youll need to sell.

Calculations are based on rates known as of December 27 2021. In Quebec the provincial sales tax is called QST Quebec Sales Tax. The Quebec Income Tax Salary Calculator is updated 202223 tax year.

No hotel tax or levy YUKON No hotel tax or levy BEYOND CANADA NEW YORK STATE New York State legislation plus munic-ipal andor county authorizations to collect taxes on their behalf. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. No additional hotel room taxes in Nunavut.

Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for. Over 117623 up to. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for.

Just enter your annual pre-tax salary. So it would be 100 - 10350 then. Ad Finding hotel tax by state then manually filing is time consuming.

5 Things To Know Before Working In Canada Entertainment Partners

Quebec Sales Tax Calculator And Details 2022 Investomatica

Self Employed Expenses Made Simple Tax Guides

Calculate Import Duties Taxes To Canada Easyship

Preparing For The 12 5 Vat Rate Crowe Uk

Hotel In Quebec City Canada Quebec City Marriott Downtown

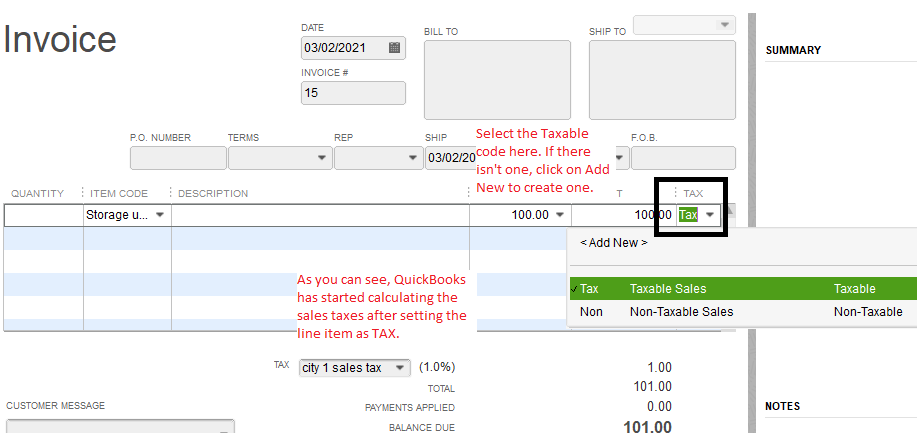

Solved How Do You Add Tax To Estimates And Invoices

What Are Sale Tax And Hotel Tax In Montreal Canada Ictsd Org

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Updated For 2022 Your Guide To Taxes In Toronto Canada

Statistics Canada Property Taxes

How To Calculate Canadian Sales Tax Gst Hst Pst Qst Impac Solutions

Canadian Tax Return Tax Calculator For Canada Moving2canada

Hotel Quartier Ascend Hotel Collection Quebec Qc 2955 Boul Laurier G1v2m2

How Much Is Hotel Tax In Montreal Lexingtondowntownhotel Com

Updated For 2022 Your Guide To Taxes In Toronto Canada

Quebec City Hotel Delta Hotels Quebec